The Influence of Plutonomy on the Luxury Market

Chairman LUXONOMY™ Group

What is Plutonomy and How Does it Impact the Global Economy?

The term plutonomy was coined by Citigroup analysts in 2005 to describe economies where most of the wealth and purchasing power are concentrated in a small elite of ultra-rich individuals, while the majority of the population has significantly limited access to economic resources. In these economies, consumption and economic growth are primarily driven by this elite, rather than by the middle or working class.

Plutonomy differs from traditional economics in that growth is not based on a fair distribution of income but on the ability of a wealthy minority to spend large sums on high-end goods and services. This economic structure has been a key driver behind the rapid expansion of the luxury industry in recent decades.

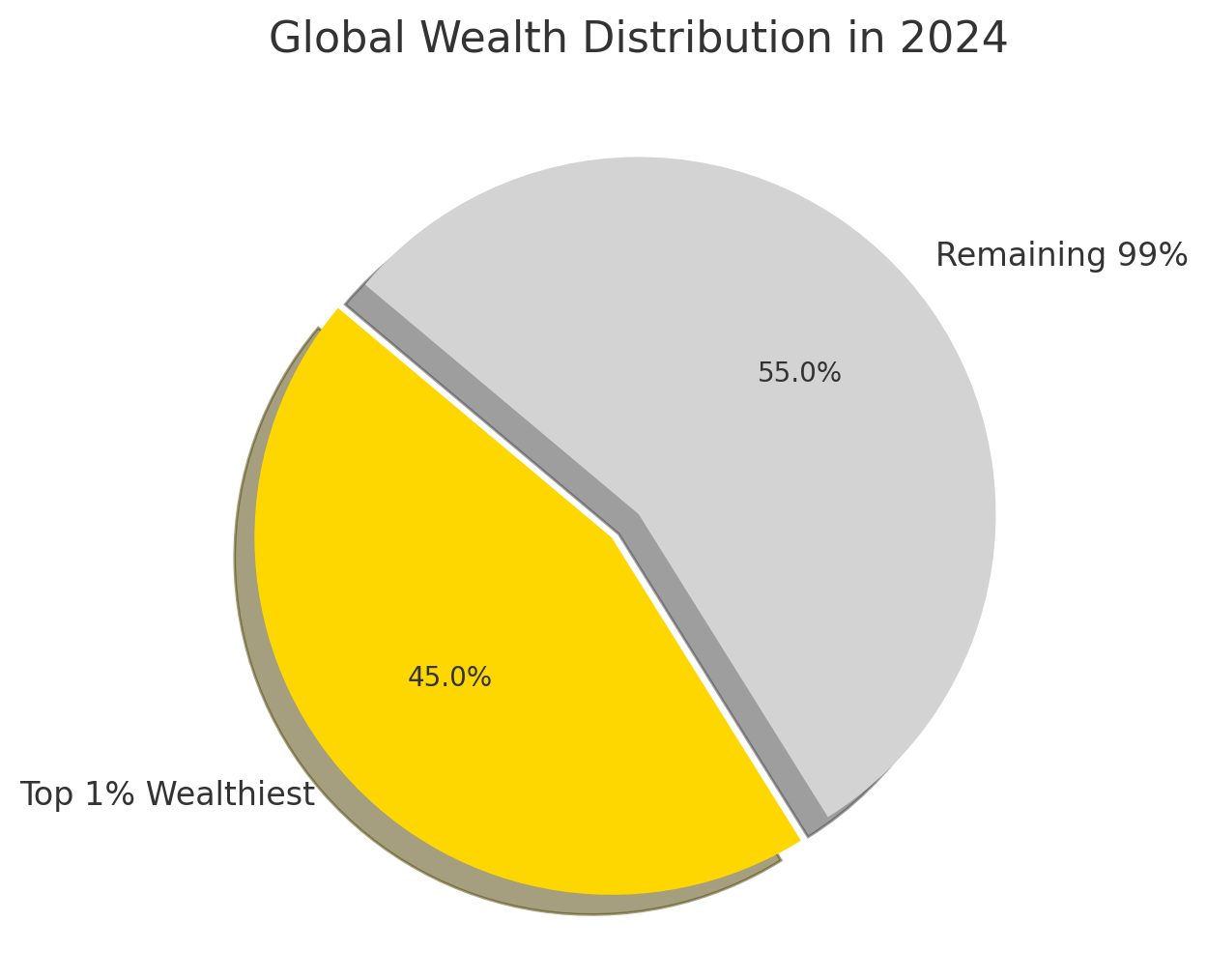

In 2024, the top 1% of the world’s population owns more than 45% of global wealth, and this concentration continues to rise. In this context, luxury brands have found in plutonomy a key engine for their growth, increasingly focusing on attracting and retaining ultra-rich customers.

The Luxury Market in the Age of Plutonomy

The rise of plutonomy has led to a transformation in the luxury market, giving rise to several key trends:

Greater Segmentation of Luxury

Luxury brands have developed strategies to specifically target the wealthiest consumers, creating products and experiences that are increasingly exclusive. A clear differentiation can be seen between:

- Accessible Luxury: Brands like Michael Kors or Coach, offering high-end products at more affordable prices.

- Premium Luxury: Brands such as Louis Vuitton, Chanel, and Gucci, catering to high-net-worth consumers.

- Ultra-Luxury: Houses like Hermès, Rolls-Royce, and Patek Philippe, offering products and experiences exclusively for the ultra-rich.

In this model, extreme luxury has become a market in itself, with goods and services designed solely for the millionaire elite.

The Rise of Very High Net Worth Individuals (VHNW) and Ultra High Net Worth Individuals (UHNWI)

The growth of plutonomy has coincided with the increasing number of millionaires and billionaires worldwide.

According to the 2024 Global Wealth Report:

- There are more than 60 million millionaires worldwide.

- Around 300,000 UHNWI (individuals with more than $30 million in net worth) exist.

- The top 1% of the world’s richest individuals have increased their wealth by more than 20% over the past five years.

These consumers are the primary clients of luxury brands, with highly exclusive consumption habits and a strong preference for personalization and hyper-exclusivity.

Expansion of Ultra-Luxury Tourism and Hospitality

Plutonomy consumers not only purchase luxury products but also seek experiences that reflect their social status.

- Exclusive resorts and hotels: Brands like Aman Resorts, Six Senses, and Cheval Blanc have elevated personalization and exclusivity in their services.

- Luxury yachts and private jets: The luxury yachting and private jet industry has seen exponential growth, with an increased demand for custom aircraft and high-tech vessels.

- Extreme tourism: Space travel with Blue Origin or Virgin Galactic, luxury submarine explorations, and private island experiences are among the latest ultra-high-end offerings.

Economic Implications of Plutonomy in the Luxury Sector

The growth of the luxury market driven by plutonomy has several economic and social implications:

Increased Stability for the Luxury Sector

Unlike other markets, luxury tends to be less affected by economic crises due to the heavy concentration of wealth among its consumers.

- During the 2008 financial crisis, while many industries suffered massive losses, exclusive luxury brands remained stable thanks to demand from the ultra-rich.

- During the 2020 pandemic, sales of ultra-luxury goods such as watches, jewelry, and high-end automobiles soared, as the wealthiest consumers continued spending.

This phenomenon occurs because the wealthiest consumers are not dependent on regular economic cycles, allowing them to maintain their spending levels even in times of uncertainty.

Widening Economic Inequality

One of the most debated effects of plutonomy is the increasing wealth gap.

- While the elite continues accumulating wealth, the middle class faces economic challenges, leading to an unequal distribution of purchasing power.

- The lack of economic redistribution can generate social tensions and protests against the economic system that favors wealth accumulation.

Luxury Taxes and Economic Regulations

To counteract the effects of plutonomy, some governments have implemented luxury taxes on goods such as yachts, high-end cars, watches, and luxury real estate.

- In France, luxury taxes have been increased to fund social welfare programs.

- In Italy and Spain, additional levies have been imposed on luxury purchases to regulate economic disparities.

However, these measures have had limited impact, as many ultra-rich individuals relocate their wealth to tax-friendly countries.

What is the Future of Plutonomy in the Luxury Market?

Plutonomy will continue to be a determining factor in luxury growth, with several key trends emerging:

- Greater personalization: Luxury brands will continue developing exclusive and highly customized services to attract and retain the billionaire elite.

- Expansion of the luxury market in Asia: China, India, and the United Arab Emirates will solidify themselves as luxury hotspots, with a growing number of millionaires and UHNWI.

- Sustainability and ethics in luxury: Plutonomy is also driving a new type of ultra-rich consumer who prioritizes ethical, sustainable, and socially responsible luxury products.

- Growth of ultra-luxury tourism: The hospitality and exclusive experiences sector will continue to flourish, with new destinations and tailor-made services designed for the world’s wealthiest consumers.

Ultimately, plutonomy has not only fueled the growth of the luxury sector but has also redefined the rules of the game, pushing brands to innovate, personalize, and adapt their strategies to an increasingly selective and demanding clientele

Share/Compártelo

- Click to share on LinkedIn (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on Threads (Opens in new window)

- Click to email a link to a friend (Opens in new window)

- Click to print (Opens in new window)

- More

Related

Discover more from LUXONOMY

Subscribe to get the latest posts sent to your email.