Luxury Slows Down and Moves Into a New Era — What to Expect in 2026

president LUXONOMY™ Group

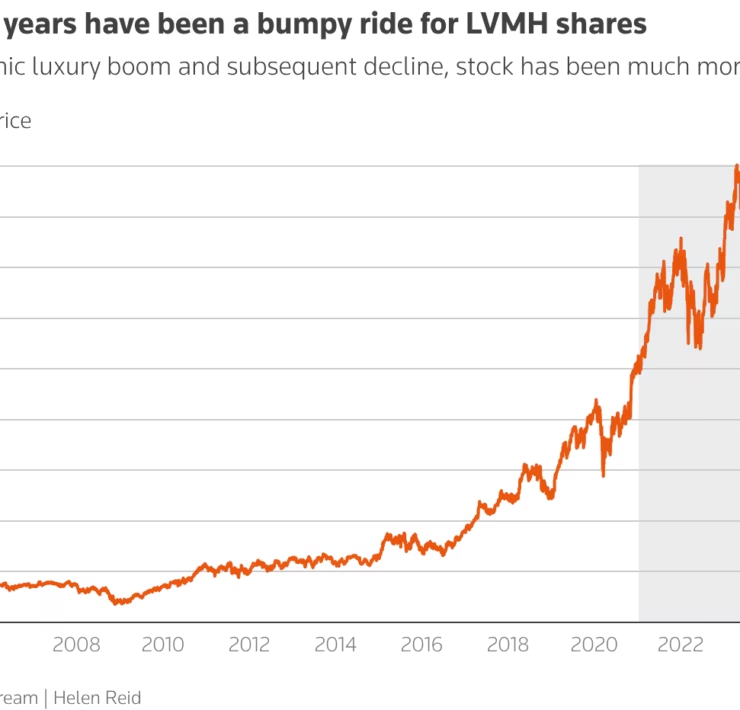

The global luxury sector closes 2025 with a clear message: this is not a collapse, but a controlled slowdown marking the start of a new strategic era. After years of accelerated expansion — driven by post-pandemic recovery, new consumer segments, and aggressive price hikes — the industry is now transitioning toward a different rhythm that will redefine the next decade.

A slowdown, not a fall

The Bain & Altagamma study indicates that personal luxury goods are expected to decline 2–5% in 2025, reaching €358–€364 billion. Analysts describe this as a correction, not a deterioration. In constant currency, the market may even end the year flat, signaling stabilization rather than crisis.

The real pressure point has been consumer fatigue following continuous price increases across nearly all major brands. The aspirational consumer — a key growth engine from 2010 to 2022 — has turned more cautious, particularly in Europe and the United States. Meanwhile, categories like watches and jewelry show resilience, while leather goods, shoes, and traditional accessories face stronger headwinds.

A consumer who no longer buys just to buy

The behavioral shifts of 2025 are reshaping the sector fundamentally.

1. From accumulation to emotional value

Shoppers demand pieces with heritage, visible craftsmanship, and artistic depth. Merely relying on brand power is proving insufficient.

2. Explosive growth in experiential luxury

Travel, fine dining, wellness, and art-driven experiences continue to grow at double digits, outperforming several product categories. Experience is becoming the new prestige.

3. A rising need for authenticity

Consumers expect coherence, cultural relevance, and creativity with intent. Brands depending on repetitive formulas are losing traction.

Regional analysis: an uneven global map

China: moderation meets maturity

While still a crucial growth engine, 2025 reveals a more disciplined and selective Chinese consumer. International tourism, however, is slowly reviving luxury spend.

Europe: price resistance

European clients feel the weight of consecutive price hikes. Tourism supports sales, but local demand remains softer.

United States: a polarized landscape

Top spenders remain strong, but aspirational consumers reduce discretionary purchases.

Middle East & Emerging Asia: sustained acceleration

Saudi Arabia, the UAE, India, and Indonesia show strong structural growth, attracting investment from major maisons.

The end of the price-hike era

One of the clearest conclusions of 2025:

the cycle of continuous price increases is reaching its limit.

Consumers are increasingly aware that prices have outpaced product innovation. Categories like leather goods and prêt-à-porter have felt the most visible pushback.

The industry must now rebuild trust through:

stronger creative direction,

more artisanal craftsmanship,

and value narratives rooted in culture rather than exclusivity alone.

2026: a potential reset

Forecasts suggest a rebound between 3% and 5% in 2026, assuming brands adapt to emerging consumer expectations.

Growth will rely on:

1. Focusing on true high-end clients

The future lies in loyal, high-spending, repeat customers rather than the aspirational mass segment.

2. A creative renaissance

Authentic artistic identity will be decisive for winning back consumer excitement.

3. Diversified channels

Private sales, curated retail, experiential events, and luxury-specialized e-commerce will gain weight.

4. Expansion in structurally growing markets

India, Saudi Arabia, Indonesia, Vietnam, and Mexico emerge as key long-term opportunities.

The big question: what will luxury represent in 2030?

2025 makes clear that luxury is entering a new paradigm. The next era belongs to brands capable of offering:

deeper craftsmanship,

cultural relevance,

integrated sustainability,

artistic collaborations,

advanced personalization,

and a more intimate, curated approach to exclusivity.

Conclusion

2025 is not the end of luxury’s growth cycle — it is the beginning of a new chapter. The industry is reorganizing, not shrinking.

2026 will reveal which brands truly understand the shift and which remain anchored in an outdated model.

LUXONOMY will continue offering global insight and strategic perspectives as the sector evolves.

Share/Compártelo

- Share on LinkedIn (Opens in new window) LinkedIn

- Share on WhatsApp (Opens in new window) WhatsApp

- Share on Facebook (Opens in new window) Facebook

- Share on X (Opens in new window) X

- Share on Threads (Opens in new window) Threads

- Email a link to a friend (Opens in new window) Email

- Print (Opens in new window) Print

- More

Related

Discover more from LUXONOMY

Subscribe to get the latest posts sent to your email.