Young consumers redefine global luxury tactics: from reach to precision, from logos to culture

president LUXONOMY™ Group

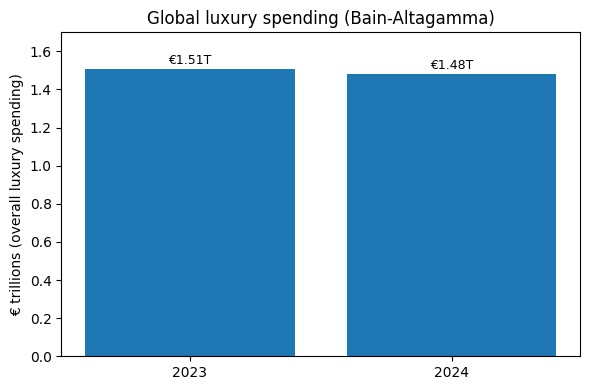

Global luxury is entering a phase in which competition is no longer decided solely by product, but by tactics. Younger consumers—especially Gen Z, and younger millennials—are pushing brands away from a broad aspirational logic toward precision strategies: less noise, more relevance; less inherited status, more cultural connection; fewer mass campaigns, more targeted activation in specific channels and moments. The macro backdrop explains part of this shift. According to Bain & Altagamma, total luxury spending (goods and experiences combined) reached €1.48 trillion in 2024, a 1%–3% decline versus 2023 after two years of strong expansion. This normalization is forcing brands to defend every euro invested.

At the core of the industry, personal luxury goods have reached a turning point. Bain estimates the segment fell to €363 billion in 2024 (−2% at current exchange rates, flat at constant rates), marking the first contraction in 15 years excluding the Covid period. The slowdown is unevenly distributed: price-sensitive consumers are pulling back more visibly, and the industry has lost an estimated 50 million customers over two years. At the same time, profitability is under pressure. Bain’s 2025 update points to EBIT margins for a selected group of brands trending toward 15–16%, comparable to post-crisis levels in 2009 and well below the 23% peak seen in 2012. In this context, tactics matter more than ever.

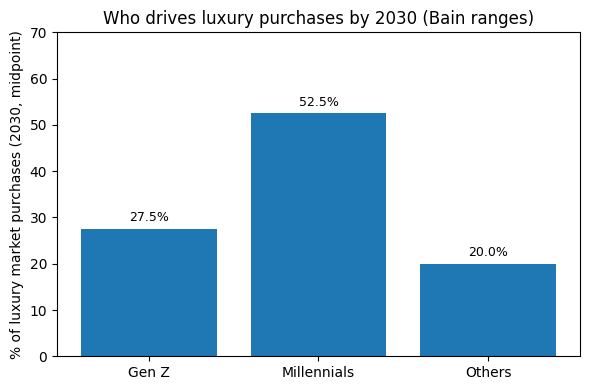

Youth is not just influencing trends—it is defining the next demand cycle. Bain projects that by 2030, Gen Z will account for 25%–30% of luxury purchases, while millennials will represent 50%–55%. More than three quarters of the market will thus be driven by cohorts whose buying logic differs fundamentally from earlier generations. Value is validated socially, amplified digitally, and legitimated through cultural coherence. This helps explain Bain’s framing of the sector’s future as a shift “from reach to precision”: presence alone is no longer enough; timing, context, and narrative dictate preference.

The most visible consequence is a redesign of the commercial and marketing mix. Entry and repeat-buy categories—fragrances, beauty, eyewear, and more accessible jewelry—are gaining strategic weight as gateways for younger consumers and as responses to tighter discretionary budgets. Bain highlights jewelry as a leading growth category in 2025, with expected expansion of 4%–6%, followed by eyewear at 2%–4%. At the same time, brand investment is increasingly justified by efficiency rather than notoriety. Creativity remains essential, but it is now paired with performance discipline, conversion metrics, and improvement—particularly in digital environments where decisions are formed long before the store visit.

Channels are the second structural shift. Younger consumers accelerate a “phygital” journey: discovery happens online, validation in communities, and buying where the experience is most seamless. Looking toward 2030, Bain expects online and mono-brand stores to emerge as leading channels. Meanwhile, wholesale and less controlled formats will lose influence over wish creation. They will also lose influence over experience. For brands, this implies deeper investment in data, CRM, and next-generation clienteling—not only to sell, but to learn quickly and adapt. Physical retail, in turn, evolves from a transactional point into a stage for experience, service, and content.

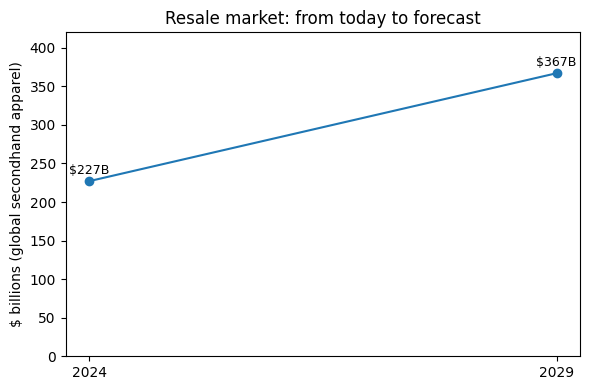

The third—and perhaps most disruptive—force is the secondary market. Younger consumers have normalized resale as part of the luxury lifecycle, combining access, rotation, and perceived responsibility. In 2024, the global secondhand apparel market was estimated at $227 billion. It represented around 9% of total fashion sales. The annual growth was near 15%, which far outpaced the broader fashion market. Forecasts suggest this market will reach $367 billion by 2029. For luxury houses, resale is no longer peripheral: it raises questions of authentication, indirect pricing control, and whether—and how—to join without diluting brand equity.

Taken together, these dynamics amount to a tactical reengineering of global luxury. Precision replaces scale; categories of access complement hero products; channel control intensifies; cultural narratives gain strategic weight; and product lifecycle management now includes resale. All this unfolds within a market that remains vast despite short-term deceleration. Bain estimated total luxury spending at €1.51 trillion in 2023, up 11%–13% versus 2022; the normalization of 2024 does not diminish the sector’s appeal, but it does harden the rules. Looking ahead to 2026, competitive advantage will belong to brands that master real-time execution—data, creativity, experience, and community—and turn today’s pressure into durable strength.

Share/Compártelo

- Share on LinkedIn (Opens in new window) LinkedIn

- Share on WhatsApp (Opens in new window) WhatsApp

- Share on Facebook (Opens in new window) Facebook

- Share on X (Opens in new window) X

- Share on Threads (Opens in new window) Threads

- Email a link to a friend (Opens in new window) Email

- Print (Opens in new window) Print

- More

Related

Discover more from LUXONOMY

Subscribe to get the latest posts sent to your email.