Luxury enters a phase of global recalibration: markets on alert, China reshapes consumption and major houses restructure

president LUXONOMY™ Group

The global luxury sector is entering a moment of transition. After more than a decade of sustained growth — interrupted only by the pandemic — the world’s leading luxury houses now face a period of strategic recalibration marked by market volatility, shifting consumption patterns in Asia and a deep internal review of operating models. Recent developments involving LVMH, evolving dynamics in China and structural changes at Alexander McQueen offer a clear snapshot of where the industry is heading.

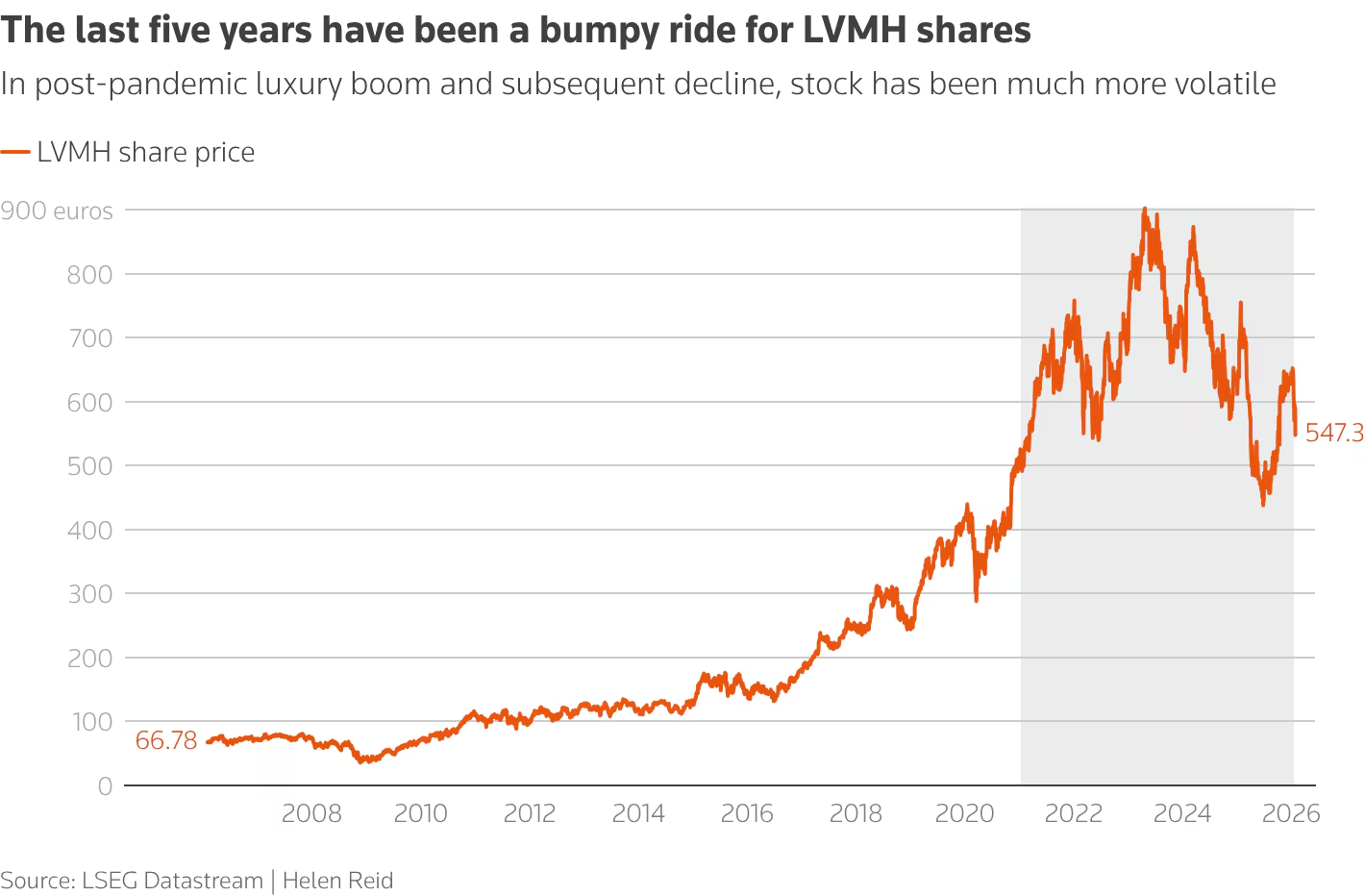

LVMH cools market sentiment and drags the sector lower

The release of LVMH’s latest quarterly results has acted as a trigger for a broader correction across European luxury stocks. While the group remains financially robust and firmly positioned as a global leader in fashion, leather goods and watches, investor expectations were higher.

Markets reacted cautiously to slower-than-anticipated growth and to a notably restrained outlook from management for the coming quarters. The message is unmistakable: luxury can no longer rely on post-pandemic momentum alone. Investors are now demanding sharper strategy, tighter cost control, tangible innovation and a far more nuanced understanding of the global consumer.

This adjustment does not point to a structural crisis, but it clearly marks the end of an expansionary phase driven by recovery dynamics. Growth going ahead will be more selective, more geographically targeted and more demanding.

China rewrites the rules: luxury decentralises

While Europe digests earnings, China is quietly reshaping the luxury landscape. For years, global brands focused almost exclusively on tier-one cities like Shanghai and Beijing. Today, luxury consumption is shifting decisively towards second-tier cities, where a sophisticated, affluent consumer base is emerging with a stronger emotional connection to brands.

Retail destinations like Deji Plaza in Nanjing have become new epicentres of premium consumption, outperforming traditional luxury landmarks in sales per square metre. This trend reflects a combination of factors: lower saturation, more loyal customers, deeper integration of retail with dining and culture, and highly localised brand strategies.

For luxury houses, the signal is clear: China remains essential, but it is no longer monolithic. The next stage of growth requires a more granular presence, tailored to each city, community and lifestyle.

Internal restructuring: efficiency, focus and profitability

At the same time, several fashion houses are reviewing their internal structures to adapt to this new cycle. Alexander McQueen, part of the Kering group, has announced a significant workforce reduction in Italy — a move that highlights mounting pressure on profitability within certain creative brands.

Far from being an isolated case, this decision reflects a broader industry trend. Luxury is redefining the balance between creativity, scale and operational efficiency. Ateliers, supply chains and corporate teams are entering a phase of improvement aimed at safeguarding long-term viability without compromising brand identity.

Creativity remains central, but every strategic decision is now expected to deliver clear economic and brand returns.

The next luxury cycle: less volume, sharper strategy

What the industry is witnessing is not a temporary slowdown, but the opening chapter of a new cycle. Near-term luxury will be more analytical, more technologically driven and more attuned to geopolitical and social context. Uncontrolled expansion gives way to precision: fewer openings, better locations; less noise, greater coherence; reduced reliance on any single market.

For global luxury groups, the challenge will be to preserve desirability while navigating a more complex economic environment. For independent houses, differentiation through authenticity and agile operating models will be key.

Luxury is not losing its appeal. It is evolving. And in that evolution, those who expect the consumer, understand territory and take decisive action will define the rhythm of the decade ahead.

Luxonomy will continue to track and interpret this transformation from a global, strategic and future-looking perspective.

Share/Compártelo

- Share on LinkedIn (Opens in new window) LinkedIn

- Share on WhatsApp (Opens in new window) WhatsApp

- Share on Facebook (Opens in new window) Facebook

- Share on X (Opens in new window) X

- Share on Threads (Opens in new window) Threads

- Email a link to a friend (Opens in new window) Email

- Print (Opens in new window) Print

- More

Related

Discover more from LUXONOMY

Subscribe to get the latest posts sent to your email.