economy

The year 2026 is shaping up as a strategic choice phase for listed luxury companies. After an extraordinary expansion cycle between 2021 and 2023, followed by normalization in 2024–2025, the sector is entering a more disciplined environment. In this context, financial institutions like JPMorgan and HSBC have identified specific opportunities grounded in two core pillars: structural brand strength and financial resilience amid mixed global economic conditions.

The geographic center of gravity in luxury is steadily shifting. While Europe remains the historic birthplace of many leading maisons, demand power is increasingly concentrated in Asia and the Middle East. By 2030, China, Japan, the Middle East, and India united represent a dominant share of incremental global luxury growth.

The next chapter of global luxury will not be defined solely by what is produced, but by where wealth is generated and how it flows. In 2026, the map of luxury expansion is unmistakably oriented toward Asia and the Middle East, with India emerging as the next structural force poised to reshape the industry’s long-term trajectory.

The global personal luxury goods market now stands at approximately USD 480 billion, after an accelerated expansion cycle between 2021 and 2024. Although growth has moderated compared to the immediate post-pandemic years, projections for the 2026–2030 period point to an average annual growth rate of 3% to 5%, with Asia, the United States, and the Middle East acting as primary engines. Within this ecosystem, the “hard luxury” segment—jewelry, watchmaking, and durable high-end goods—continues to show stronger resilience than categories more closely tied to seasonal consumption.

If the earlier decade was defined by consolidation and store rollouts, the current one will be shaped by deep cultural integration in emerging regions, experiential tourism aligned with identity and tradition, and Generation Z as architect of commercial design. Saudi Arabia is constructing a platform that blends heritage, innovation, and ambition, while India demonstrates that luxury growth depends on community, narrative, and generational alignment. The global luxury map is no longer drawn exclusively from Paris or Milan. It is increasingly shaped from Riyadh and Mumbai, with a long-term vision that extends well beyond retail and into influence, culture, and systemic transformation.

Taken together, these dynamics amount to a tactical reengineering of global luxury. Precision replaces scale; categories of access complement hero products; channel control intensifies; cultural narratives gain strategic weight; and product lifecycle management now includes resale. All this unfolds within a market that remains vast despite short-term deceleration. Bain estimated total luxury spending at €1.51 trillion in 2023, up 11%–13% versus 2022; the normalization of 2024 does not diminish the sector’s appeal, but it does harden the rules. Looking ahead to 2026, competitive advantage will belong to brands that master real-time execution—data, creativity, experience, and community—and turn today’s pressure into durable strength.

What the industry is witnessing is not a temporary slowdown, but the opening chapter of a new cycle. Near-term luxury will be more analytical, more technologically driven and more attuned to geopolitical and social context. Uncontrolled expansion gives way to precision: fewer openings, better locations; less noise, greater coherence; reduced reliance on any single market.

After two years shaped by slowdown and adjustment, the global luxury market is beginning to show clear signs of recovery. The latest forecasts show that 2026 will mark the start of a new growth phase, driven by the resilience of high-net-worth consumers, strategic recalibration by leading maisons, and the strong performance of key categories like jewellery.

The American luxury ecosystem is going through one of the most delicate moments in its recent history. Saks Global, the group formed after the integration of Saks Fifth Avenue and Neiman Marcus, is preparing to seek protection under Chapter 11 of the U.S. bankruptcy code. This move goes far beyond a financial adjustment and raises fundamental questions about the future of high-end physical retail.

2026 is shaping up as a year of recalibration for the global luxury industry, with moderate yet steady growth driven primarily by the United States. After a period of global adjustment, leading luxury houses are refocusing their strategies on a market that combines purchasing power, cultural influence and a strong appetite for experience-led consumption.

China has approved a sweeping revision of its Foreign Trade Law that will come into force in March 2026, marking one of the most ambitious updates to the country’s trade framework in more than two decades. The reform equips Beijing with broader legal instruments to manage external trade pressure, accelerate digital and green commerce, and redefine the rules of engagement for foreign brands operating in or with the Chinese market.

For the luxury industry, the implications go far beyond regulation. This is a structural recalibration of how China positions itself within global value chains, digital trade flows and geopolitical commerce dynamics.

A law designed for a fragmented global trade era

The revised law strengthens the Chinese government’s ability to respond to what it defines as “unfair trade practices” and external restrictions. Authorities will be empowered to deploy countermeasures, adjust export controls, and intervene more decisively when supply chains, strategic industries or national economic interests are perceived to be at risk.

While the text avoids explicit country references, the context is clear: China is preparing for prolonged trade volatility and accelerating decoupling scenarios in selected sectors. This new legal backbone gives policymakers flexibility to act rapidly, rather than relying on ad hoc administrative measures.

From a luxury perspective, this means greater predictability at the policy level, but also higher expectations of compliance, transparency and digital traceability for brands moving goods, data and capital across borders.

Digital trade moves to the center

One of the most transformative aspects of the reform is the formal integration of digital trade into China’s foreign trade governance. The law explicitly supports cross-border digital services, electronic documentation, digital signatures and platform-based trade mechanisms.

For luxury brands, this reinforces China’s ambition to become a global reference point for digitally enabled commerce, especially in areas such as:

Cross-border e-commerce and bonded warehouses

Digital customs clearance and smart logistics

Online luxury retail targeting Chinese consumers abroad and at home

This evolution aligns with China’s broader push to shape international digital trade standards, potentially influencing future negotiations within bodies such as the World Trade Organization.

Green trade and sustainability as regulatory infrastructure

The revised law also embeds green trade into the legal architecture of foreign commerce. This includes incentives and regulatory pathways for environmentally efficient logistics, sustainable production and low-carbon trade practices.

For luxury houses increasingly judged on ESG performance, China is signaling that sustainability will no longer be a reputational add-on, but part of the operational baseline. Brands unable to document environmental compliance across sourcing, manufacturing and logistics may face friction as regulatory scrutiny intensifies.

In practical terms, sustainability reporting, product traceability and verified green certifications are likely to become essential to maintain market agility in China over the next decade.

Intellectual property: protection and responsibility

The law reinforces intellectual property protection while simultaneously demanding stronger enforcement cooperation from foreign operators. This dual approach reflects China’s desire to be seen as both a defender of innovation and a regulator that expects proactive compliance.

Luxury brands benefit from stronger legal tools against counterfeiting, yet they will also face higher obligations to:

Register and defend trademarks and designs locally

Monitor distribution channels more actively

Respond swiftly to regulatory or judicial requests

The message is clear: China wants global brands deeply embedded in its legal ecosystem, not operating at arm’s length.

Strategic zones and the role of Hainan

Special trade zones, particularly Hainan, remain central to China’s luxury strategy. Duty-free retail, cross-border consumption and pilot digital trade frameworks position the island as a living laboratory for the new law’s ambitions.

For luxury groups, Hainan continues to serve as a bridge between domestic demand and international brand positioning, with regulatory experimentation that may later be scaled nationwide.

What luxury leaders should prepare for now

Although implementation begins in 2026, strategic preparation must start immediately. The revised Foreign Trade Law reshapes the operating environment in four decisive ways:

Compliance becomes strategic – legal, digital and sustainability frameworks converge

Digital infrastructure is no longer optional – trade, data and logistics must be integrated

Supply chains require geopolitical resilience – agility will outweigh cost optimization

China’s market logic evolves – access remains vast, but expectations rise

For luxury executives, China is not closing its doors. It is redesigning the entrance.

The brands that thrive will be those that understand the law not as a constraint, but as a blueprint for how China envisions its role in global commerce: technologically advanced, environmentally disciplined and strategically autonomous.

As global trade fragments and consumption patterns shift, this reform positions China to shape the next chapter of international luxury exchange—on its own terms.

After two years of volatility, China is once again entering an expansion phase that is reshaping the global luxury landscape. In 2026, the country regains its position as one of the sector’s most powerful growth engines, driven by young consumers, a renewed appetite for premium experiences, and the rise of a new generation of local luxury brands.

The personal luxury goods market — including handbags, fashion, jewelry, beauty, watches and accessories — is expected to close 2025 at around €358 billion, slightly below 2024 levels. The analysis suggests that 2025 will be a year of stabilization after several cycles marked by price hikes, economic uncertainty and more cautious spending habits.

The global luxury and fashion industry enters 2026 facing an environment where long-established rules no longer apply. Market stability is shifting, consumers are becoming more complex, and brands must navigate a world where technology, wellbeing, creativity and efficiency intersect. McKinsey and The Business of Fashion identify ten forces that will guide this new stage.

After a decade of uninterrupted growth, the global luxury industry is entering a new cycle defined by prudence, redefined value, and long-term sustainability. According to McKinsey & Company’s State of Luxury 2025 report, annual growth for the sector is expected to slow to between 1% and 3% through 2027, signaling the end of the post-pandemic boom and the beginning of a more selective, value-driven era.

Luxury is no longer defined by what you own, but by what you experience. According to Euromonitor International and Bain & Company, the experiential luxury segment — including exclusive travel, hospitality, wellness, gastronomy, and immersive retail — grew 8% in 2025, reaching an estimated $103 billion.

The luxury industry is entering a phase of reflection. After years of record expansion driven by aspirational consumers, the younger generations —Gen Z and early millennials— are redefining their relationship with luxury. It is no longer about possession, but about justifying the value of every purchase.

According to the Bain-Altagamma 2025 report, the sector is experiencing a “healthy slowdown” after years of euphoria, showing flat or slightly negative growth. Luxury houses are recalibrating: focusing less on volume and more on purpose, profitability, and genuine emotional connection with the client.

The accessible luxury sector —that delicate balance between aspiration and attainability— is heading into a decisive week as Capri Holdings, Tapestry Inc., and Ralph Lauren Corporation prepare to unveil their latest quarterly results, offering valuable insight into the state of U.S. premium consumption.

Under CEO Benedetto Vigna, Ferrari maintains its guidance for the year, with operating margins above 30 %, confirming its status as the world’s most profitable car brand. Investors will closely watch updates on its electrification strategy, the new solar-powered Maranello plant, and the expansion of its high-margin Tailor Made customization program.

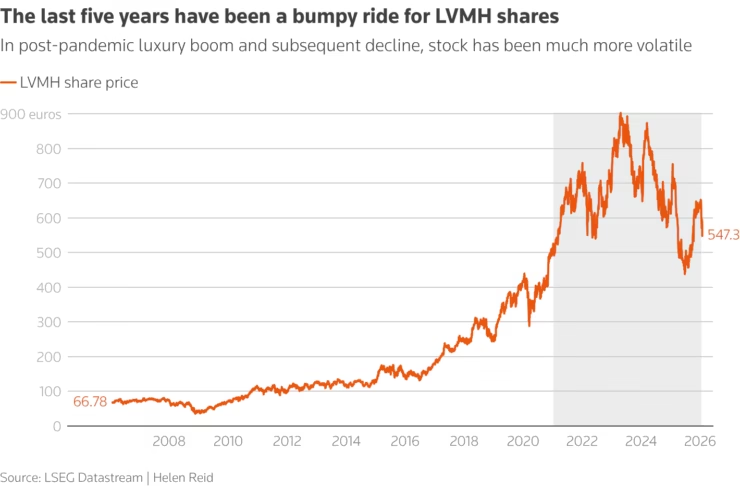

The announcement triggered a market-wide rally: LVMH shares soared as much as 14% on October 15, lifting the entire sector and adding roughly US $80 billion in market value to the STOXX Europe Luxury 10 Index, which tracks Europe’s leading luxury groups. Brands such as Hermès, Richemont, and Kering also rose between 5% and 8% in the wake of the news.