Impact of Trump’s Presidency on the Global Luxury Market: Analysis of Geopolitical and Economic Consequences

president LUXONOMY™ Group

The re-election of Donald Trump as President of the United States has brought significant geopolitical and economic changes that impact multiple industries, including the global luxury market. His focus on protectionist policies, an aggressive stance on trade relations with China and the European Union, and his tax reduction strategy have altered the dynamics of luxury goods consumption and production.

This report provides an in-depth analysis of the consequences of these changes, focusing on the effects on international trade, the production and distribution of luxury brands, the business strategies adopted to mitigate adverse effects, and consumer behavior in the U.S., China, and Europe. Additionally, future perspectives for the luxury market are explored in the context of political and economic uncertainty.

Protectionist Trade Policy and Its Impact on the Luxury Market

Increase in Tariffs and Its Effect on Luxury Goods Imports

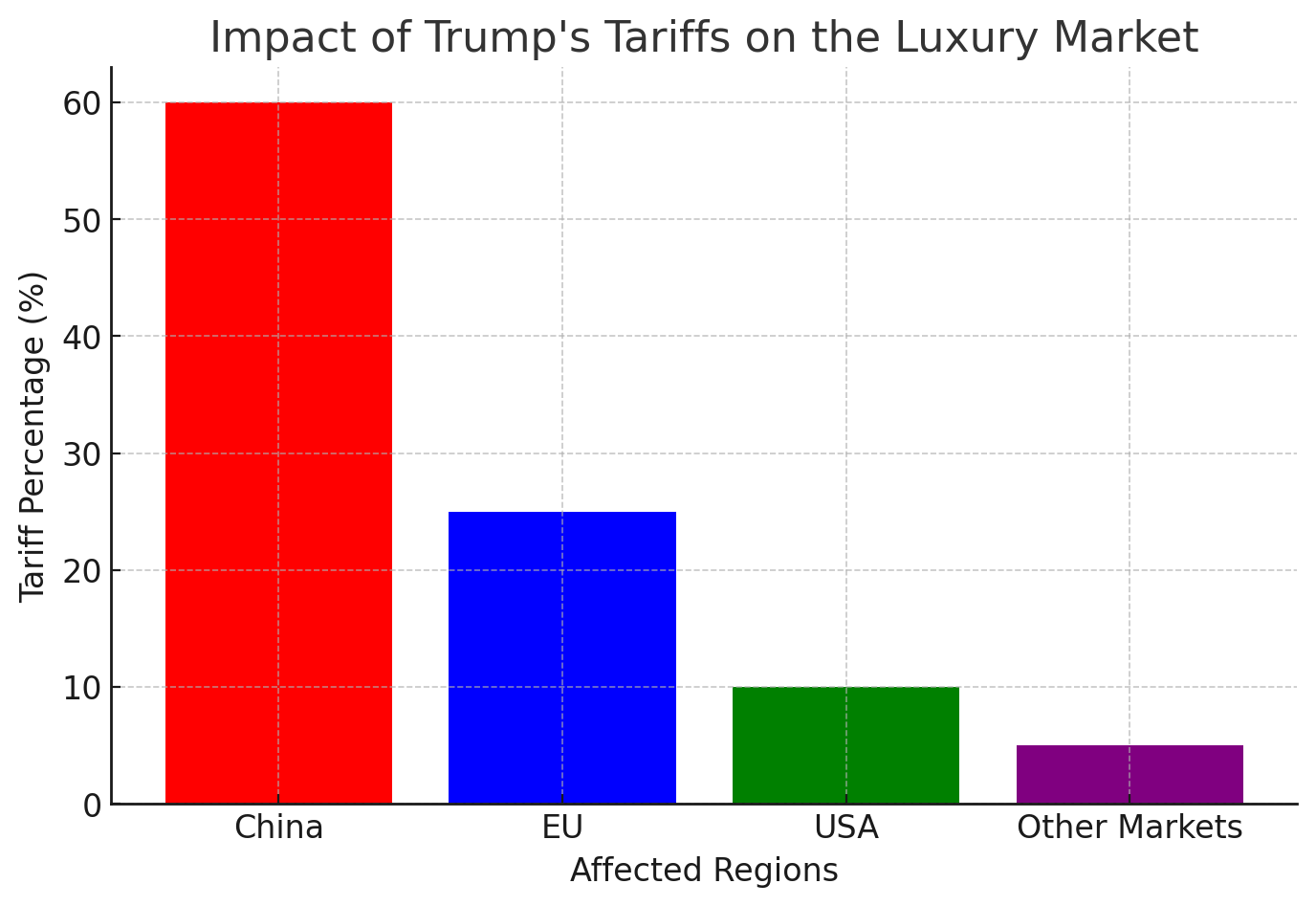

Since returning to the White House, Trump has reinforced his protectionist policy by imposing tariffs on imported products. His goal has been to reduce the U.S. trade deficit and stimulate domestic production, affecting the luxury industry, which heavily relies on imports.

Tariffs on China and Their Impact on the Luxury Industry

China is a key player in the global luxury supply chain, not only as a manufacturer of high-end products but also as one of the largest consumers of these goods. However, with tariffs of up to 60% on Chinese imports, many brands have opted to shift production to other Southeast Asian countries such as Vietnam and India.

Three key effects have emerged from this:

- Increase in production costs: Relocating factories involves investments in new infrastructure and employee training, leading to higher operational costs.

- Supply chain delays: Transitioning to new markets has created disruptions in production, affecting product availability in the U.S. and Europe.

- Adjustments in final prices: Some brands have transferred additional costs to consumers by raising product prices in the U.S.

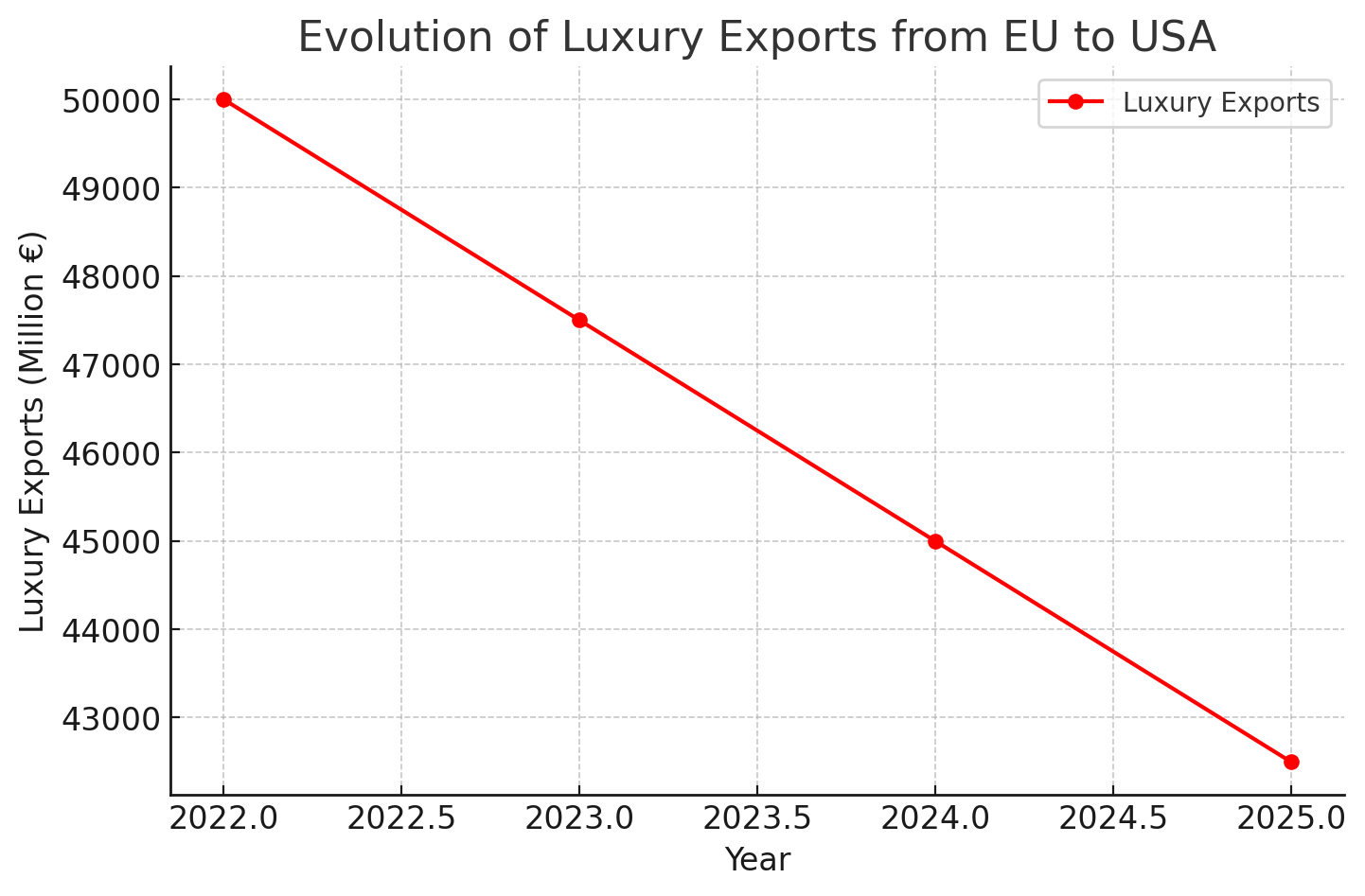

Tariffs on the European Union and the Crisis in Luxury Exports

The European luxury market, represented by firms such as Louis Vuitton, Gucci, Hermès, and Ferrari, has been hit hard by Trump’s tariff policies. The U.S. has increased import taxes on luxury products from the EU, including fashion items, watches, wines, and high-end automobiles.

This change has reduced the competitiveness of European brands in the U.S. market, which has traditionally been one of their main customers. In response, some companies have intensified efforts to attract consumers in emerging markets such as India and the Gulf countries.

Luxury Brands’ Response to Geopolitical Changes

Production Diversification

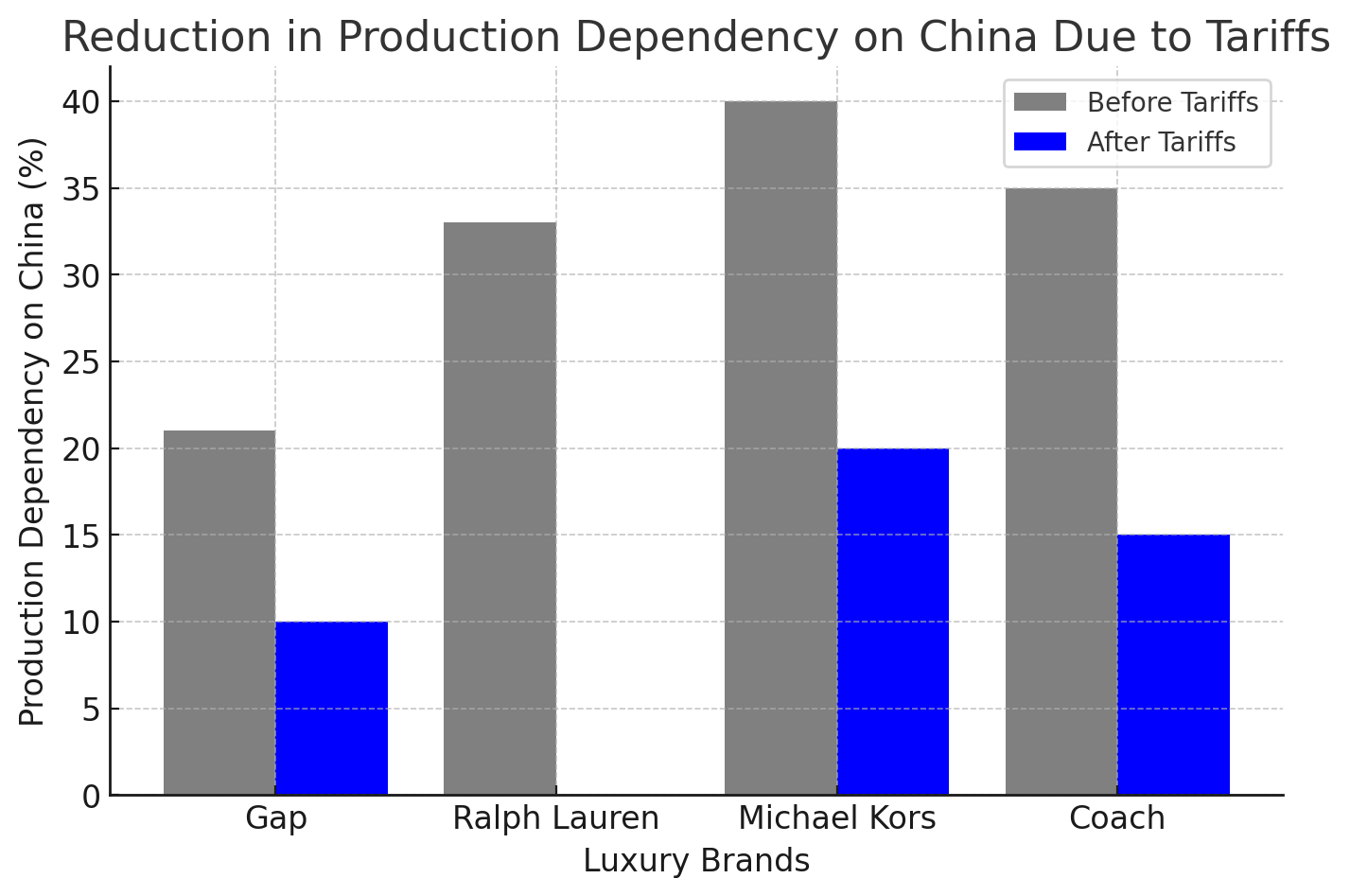

Companies such as Ralph Lauren, Michael Kors, and Coach have reduced their dependence on manufacturing in China, shifting some production to lower-cost countries. Below are some strategies adopted:

- Gap Inc. reduced its imports from China from 21% to 10%, while Ralph Lauren cut its dependence from 33% to nearly zero.

- LVMH and Kering increased production in European countries such as Italy and France to avoid additional tariffs.

- Rolex and Patek Philippe strengthened their manufacturing strategy in Switzerland to maintain quality control and avoid tariff-related costs.

Expansion in Emerging Markets

Since trade barriers have made it harder to access traditional markets like the U.S. and China, many brands have focused their strategies on attracting consumers from emerging markets:

- India and Southeast Asia have seen an increase in luxury goods consumption due to the growth of the upper-middle class and improved commercial infrastructure.

- The Middle East remains a key market, with rising high-end brand sales driven by oil wealth and government investments in luxury tourism.

Changes in Luxury Consumer Behavior Across Different Regions

United States: Rise of Domestic Luxury Consumption

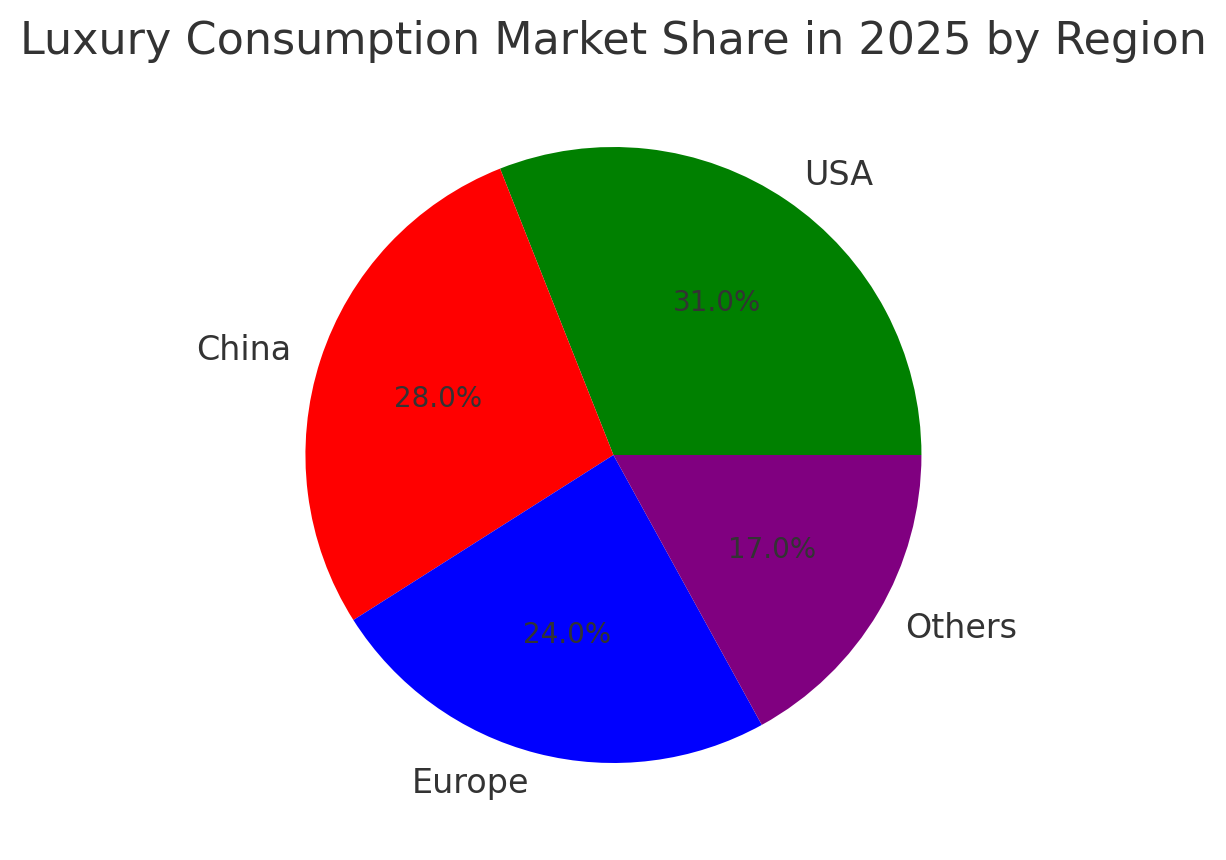

The U.S. has reinforced its role as the world’s leading luxury market, accounting for 31% of global consumption. Several factors have driven this trend:

- Income and capital tax cuts, increasing liquidity among high-net-worth consumers.

- Greater economic confidence in financial stability under the Trump administration.

- Increase in domestic luxury tourism due to travel restrictions and economic protectionism.

However, price increases resulting from tariffs could slow this growth in the coming years.

China: Slowdown in Luxury Consumption

China has historically been the biggest driver of luxury market growth, but a combination of the real estate crisis, travel restrictions, and trade tensions with the U.S. has led to a decline in luxury goods consumption. Key reasons include:

- Lower investment in real estate: The property sector crisis has affected the wealth of China’s upper-middle class.

- Greater government control over luxury spending: The Chinese government has intensified anti-corruption measures, limiting extravagant spending.

- Travel restrictions: The drop in international travel has affected luxury purchases in cities like Paris, London, and Milan.

Europe: A Market in Transition

Europe remains a hub for luxury production and consumption, but economic uncertainty and declining Chinese tourism have created new challenges for brands.

- Growth of sustainable luxury: Brands are investing in eco-friendly materials and ethical production to attract environmentally conscious consumers.

- Increase in local purchases: The depreciation of the euro against the dollar has led European consumers to prefer buying luxury products within the continent.

Future Perspectives for the Luxury Market

As luxury brands adapt to the geopolitical and economic changes driven by Trump’s presidency, several key trends emerge:

- Greater market digitalization: Companies will continue investing in e-commerce platforms and personalized shopping experiences to attract global customers.

- Expansion into alternative markets: Africa, Latin America, and Southeast Asia are emerging as regions with strong growth potential.

- Increased product segmentation: Brands will develop specific collections tailored to different markets and tax regulations.

- Adaptation to political instability: The sector will need to diversify strategies to cope with potential changes in trade and monetary policies.

The global luxury market has entered a phase of transformation driven by Trump’s economic policies. Trade tensions, changes in production, and shifts in consumer behavior have forced brands to rethink their strategies to maintain their position in a changing environment. As the world adapts to this new reality, luxury brands will need to find innovative ways to sustain their exclusivity, relevance, and profitability in the future

Share/Compártelo

- Share on LinkedIn (Opens in new window) LinkedIn

- Share on WhatsApp (Opens in new window) WhatsApp

- Share on Facebook (Opens in new window) Facebook

- Share on X (Opens in new window) X

- Share on Threads (Opens in new window) Threads

- Email a link to a friend (Opens in new window) Email

- Print (Opens in new window) Print

- More

Related

Discover more from LUXONOMY

Subscribe to get the latest posts sent to your email.