Description

📊 LUXONOMY™ Report: Arab Luxury 2025–2030

The Luxury Sector in the Arabian Peninsula. Projections Through 2030

The luxury sector in the Arabian Peninsula has experienced remarkable growth, becoming a global epicenter that spans fashion, real estate, luxury automobiles, fine jewelry, and exclusive experiences. This report analyzes the market dynamics in countries such as Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, the United Arab Emirates (UAE), and Yemen, highlighting the opportunities and challenges each one faces.

The GCC luxury market is expected to surpass USD 30 billion by 2030, fueled by strong economic expansion and the emergence of major new mega-projects.

Why is this report essential for your Middle East strategy?

📊 Contains the most up-to-date data on the luxury market in the region

📈 Realistic and detailed projections through 2030

👤 Exclusive infographics on luxury consumer profiles by country

📍 Country-by-country comparisons including market share and local strategies

📦 Over 20 high-quality charts: consumption, tourism, digitalization, women, e-commerce, automotive, real estate…

✅ You will discover:

What the Arab luxury consumer really wants

Where the opportunities lie for global brands

How Gen Z, Millennials, and affluent women behave in the region

Which sectors are growing fastest: wellness, hospitality, experiences, modest fashion, digital luxury…

What strategies governments and major retailers are implementing through 2030

📌 Ideal for:

Fashion, beauty, automotive, watchmaking, hospitality, and real estate brands

Consultants, agencies, investors, and executives in the luxury sector

Marketing, international expansion, and global trends professionals

📌 Technical Details:

Title: Arab Luxury 2025–2030. The Luxury Sector in the Arabian Peninsula. Projections Through 2030

Format: PDF

Pages: 90

Language: English

Includes: Charts, real cases, empathy maps, projections to 2030

License: Individual or corporate use under agreement

Published by: LUXONOMY™ Market Intelligence

Table of Contents

General Introduction

1.1. Purpose of the Report

1.2. Methodology of Analysis

1.3. Socioeconomic Context of the Region

1.4. Luxury as a Pillar of Economic Diversification

General Overview of the Luxury Market in the Arabian Peninsula

2.1. Market Size and Growth (2024–2030)

2.2. Market Share by GCC Country

2.3. Comparison within the MENA Region

2.4. Mega Projects and Their Impact on Luxury

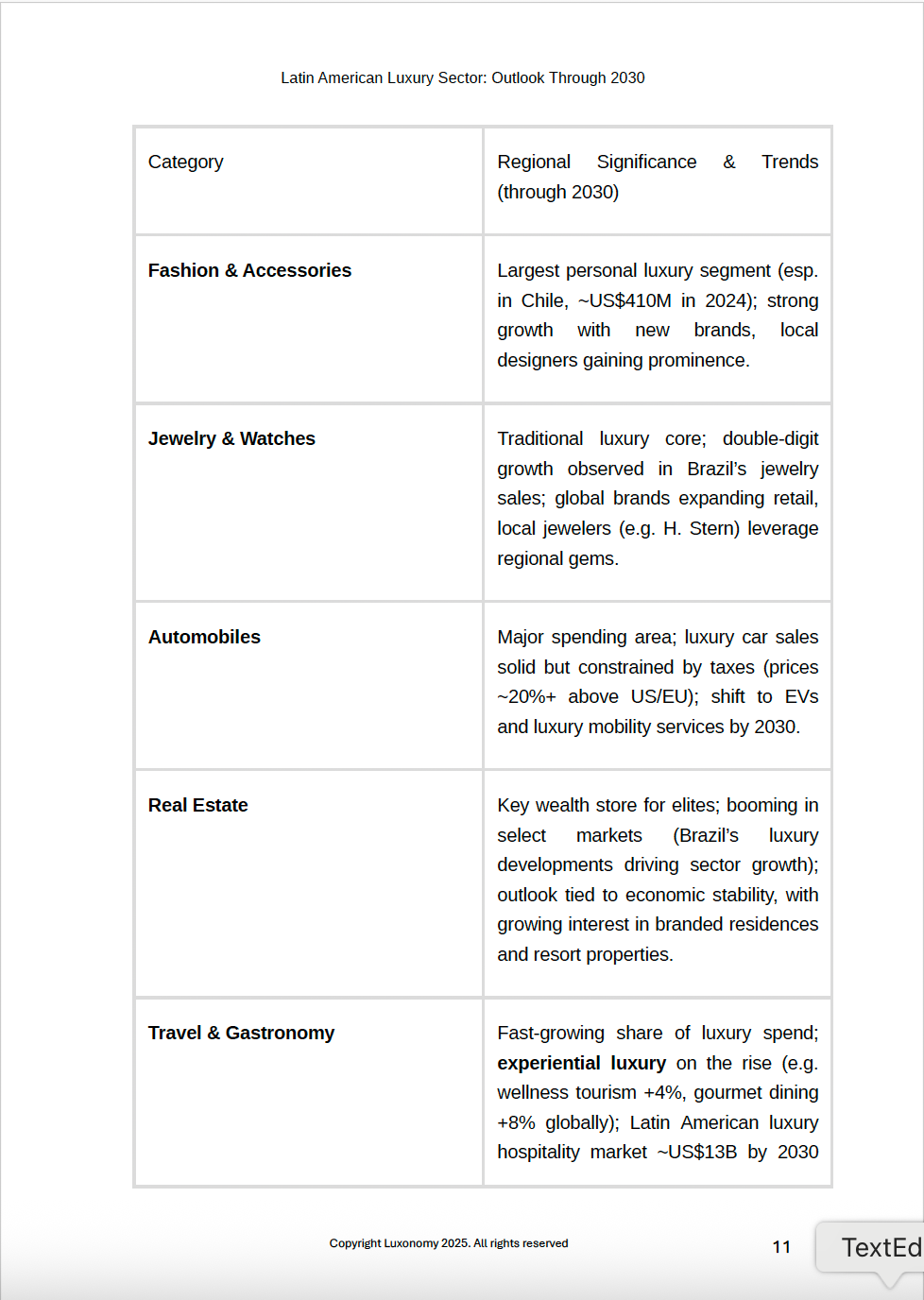

Key Luxury Sectors in the Region

3.1. Fashion and Haute Couture

3.1.1. Market Figures

3.1.2. Leading Brands and Retail Groups

3.1.3. Consumer Trends (modest fashion, personalization, e-commerce)

3.2. Luxury Real Estate

3.2.1. Prime Markets and Iconic Developments

3.2.2. Leading Real Estate Developers

3.2.3. International Investment and Golden Visas

3.3. Luxury Hospitality (Hotels and Resorts)

3.3.1. Growth in Premium Hotel Supply

3.3.2. International Brands vs. Local Initiatives

3.3.3. New Concepts: Cultural, Wellness, and Experiential Tourism

3.4. Luxury Automobiles

3.4.1. Preferred Brands and Import Volumes

3.4.2. Customization, Collecting and Electric Mobility

3.4.3. Shows, Exhibitions and Car Culture

3.5. Jewelry and Watchmaking

3.5.1. Traditional Preferences vs. European High Jewelry

3.5.2. Local Houses and Regional Distributors

3.5.3. Gift Culture and Collecting

3.6. Art and Collectibles

3.6.1. Museums, Art Fairs and Biennials

3.6.2. Auctions and Strategic Acquisitions

3.6.3. Role of Governments and Patronage

3.7. Exclusive Experiences

3.7.1. Bespoke Travel and Destination Luxury

3.7.2. Signature Dining and Fine Gastronomy

3.7.3. High-End Wellness and Medical Tourism

3.7.4. VIP Events and Immersive Lifestyle

Government Policies and Strategic Frameworks

4.1. Saudi Arabia – Vision 2030

4.2. United Arab Emirates – Visions 2021 and 2031

4.3. Qatar – National Vision 2030

4.4. Kuwait – Vision 2035

4.5. Oman – Vision 2040

4.6. Bahrain – Economic Vision 2030

4.7. Yemen – Post-Conflict Potential

4.8. Public Policy Impact on the Luxury Ecosystem

4.9. Sustainability, Education, and Local Talent

Luxury Consumer Profiles by Country

5.1. Saudi Arabia

5.1.1. From Global Shoppers to Local Buyers

5.1.2. Youth, Female Luxury and Social Media

5.1.3. Halal Luxury and Cultural Demands

5.2. United Arab Emirates

5.2.1. Diverse Consumer Profiles

5.2.2. Digitalization, Status, and Omnichannel Expectations

5.2.3. Aspirational Lifestyle and Innovation

5.3. Qatar

5.3.1. Exclusivity, Privacy and Sophisticated Taste

5.3.2. Influence of Royal Family and Art as Status Symbol

5.3.3. Cultural Luxury and Niche Perfumery

5.4. Kuwait

5.4.1. Fashion-Forward and Luxury Tech Leaders

5.4.2. Regional Influencers and Sophistication

5.4.3. Female Consumption and Authenticity

5.5. Oman

5.5.1. Discretion, Tradition and Private Elegance

5.5.2. High-End Without Ostentation

5.5.3. Emerging Consumption Among Young Professionals

5.6. Bahrain

5.6.1. Hybrid Style Between Tradition and Modernity

5.6.2. Luxury Social Life and Private Clubs

5.6.3. Resale, Collecting and Accessible Luxury

5.7. Yemen

5.7.1. Elite Abroad and Diaspora Consumption

5.7.2. Cultural Heritage as Future Luxury Asset

5.7.3. Post-Conflict Potential: Ecotourism, Socotra, and Craftsmanship

Global Trends and Regional Impact

6.1. Extreme Personalization and Clienteling

6.2. Online Luxury Shopping and Augmented Reality

6.3. Sustainability, Craftsmanship, and Circular Economy

6.4. Immersive Experiences and Purpose-Driven Tourism

6.5. Crypto-Luxury, NFTs and Metaverses

Forecasts and Scenarios Towards 2030

7.1. Total Market Value in 2030

7.2. Rise of Gen Z and Alpha Affluent Consumers

7.3. Emergence of Local Luxury Brands

7.4. Future Cities (NEOM, Lusail, Dubai 2.0)

7.5. Strategic Risks and Challenges

7.6. Role of Technology, AI and Sustainable Design

7.7. Global Positioning of “Arab Luxury”

Final Conclusions

8.1. Keys to Regional Success

8.2. Strategic Recommendations for Global Brands

8.3. Investment Opportunities

8.4. Future Vision: From Consumption to Cultural Leadership

Discover more from LUXONOMY

Subscribe to get the latest posts sent to your email.