China

For more than two decades, international luxury in China revolved around two undisputed poles: Beijing and Shanghai. These cities concentrated premium spending, the most ambitious flagships, and global brand narratives. Yet the outlook for 2025 and 2026 reveals a very different landscape. China is not stepping away from luxury—it is transforming where and how it is consumed.

Today, the market’s momentum is increasingly found in so-called second-tier cities that have moved beyond the “emerging” label to become real centers of economic, cultural, and aspirational power. Places like Nanjing, Hangzhou, and Changsha are reshaping the strategies of global luxury houses and forcing the industry to rethink its approach to the Chinese consumer.

Italian fashion house Miu Miu is redefining how Chinese New Year fits into the global luxury strategy. Rather than treating the celebration as a seasonal sales opportunity, the brand has transformed it into a recurring cultural platform, designed to build long-term engagement with Chinese consumers, particularly younger urban audiences.

The Swiss luxury group Richemont, owner of some of the industry’s most influential maisons, including Cartier, has opened the year with a reassuring message for the global luxury market: China is beginning to stabilise and once again acts as a source of confidence for the sector. The group has reported quarterly results above market expectations, driven primarily by the strength of its jewellery division and a gradual improvement in Asian consumer demand.

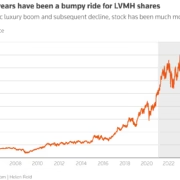

French luxury group LVMH, the world’s leading luxury player, has taken a decisive step in redefining its footprint in Asia by agreeing to sell the Hong Kong and Macau retail operations of its subsidiary DFS Group, along with related Greater China intangible assets. The buyer is China Tourism Group Duty Free, China’s dominant duty-free retailer. The deal value, reported by Reuters, is around $395 million.

The luxury industry is entering a new phase defined by three clear forces: the growing dominance of high-end jewelry, a gradual stabilization of consumption in China after years of volatility, and a profound reinvention of physical retail, now increasingly focused on experience, culture and emotional connection. Within this landscape, major international groups are recalibrating their strategies while strong local players rise with confidence and global ambition.

The celebration of the 130th anniversary of the Monogram by Louis Vuitton has found in Shanghai a strategic stage to deploy one of the most ambitious activations in contemporary luxury. The French maison has integrated a high-impact immersive pop-up into its global anniversary program, reinforcing the Chinese city’s role as a laboratory for cultural, commercial, and digital innovation within the premium sector.

China is once again reshaping the relationship between money, consumption, and commercial strategy. From January 1, 2026, the digital yuan (e-CNY) will no longer work solely as “digital cash” and will instead serve as an interest-bearing digital deposit, allowing eligible balances held in official wallets to earn interest, managed by authorized commercial banks under the oversight of the People’s Bank of China.

This move marks a new phase in the evolution of sovereign digital currencies and carries direct implications for premium retail, experiential luxury, and high-end commercial activations, particularly during peak seasonal consumption periods like Chinese New Year and the first quarter of the year.

China has approved a sweeping revision of its Foreign Trade Law that will come into force in March 2026, marking one of the most ambitious updates to the country’s trade framework in more than two decades. The reform equips Beijing with broader legal instruments to manage external trade pressure, accelerate digital and green commerce, and redefine the rules of engagement for foreign brands operating in or with the Chinese market.

For the luxury industry, the implications go far beyond regulation. This is a structural recalibration of how China positions itself within global value chains, digital trade flows and geopolitical commerce dynamics.

A law designed for a fragmented global trade era

The revised law strengthens the Chinese government’s ability to respond to what it defines as “unfair trade practices” and external restrictions. Authorities will be empowered to deploy countermeasures, adjust export controls, and intervene more decisively when supply chains, strategic industries or national economic interests are perceived to be at risk.

While the text avoids explicit country references, the context is clear: China is preparing for prolonged trade volatility and accelerating decoupling scenarios in selected sectors. This new legal backbone gives policymakers flexibility to act rapidly, rather than relying on ad hoc administrative measures.

From a luxury perspective, this means greater predictability at the policy level, but also higher expectations of compliance, transparency and digital traceability for brands moving goods, data and capital across borders.

Digital trade moves to the center

One of the most transformative aspects of the reform is the formal integration of digital trade into China’s foreign trade governance. The law explicitly supports cross-border digital services, electronic documentation, digital signatures and platform-based trade mechanisms.

For luxury brands, this reinforces China’s ambition to become a global reference point for digitally enabled commerce, especially in areas such as:

Cross-border e-commerce and bonded warehouses

Digital customs clearance and smart logistics

Online luxury retail targeting Chinese consumers abroad and at home

This evolution aligns with China’s broader push to shape international digital trade standards, potentially influencing future negotiations within bodies such as the World Trade Organization.

Green trade and sustainability as regulatory infrastructure

The revised law also embeds green trade into the legal architecture of foreign commerce. This includes incentives and regulatory pathways for environmentally efficient logistics, sustainable production and low-carbon trade practices.

For luxury houses increasingly judged on ESG performance, China is signaling that sustainability will no longer be a reputational add-on, but part of the operational baseline. Brands unable to document environmental compliance across sourcing, manufacturing and logistics may face friction as regulatory scrutiny intensifies.

In practical terms, sustainability reporting, product traceability and verified green certifications are likely to become essential to maintain market agility in China over the next decade.

Intellectual property: protection and responsibility

The law reinforces intellectual property protection while simultaneously demanding stronger enforcement cooperation from foreign operators. This dual approach reflects China’s desire to be seen as both a defender of innovation and a regulator that expects proactive compliance.

Luxury brands benefit from stronger legal tools against counterfeiting, yet they will also face higher obligations to:

Register and defend trademarks and designs locally

Monitor distribution channels more actively

Respond swiftly to regulatory or judicial requests

The message is clear: China wants global brands deeply embedded in its legal ecosystem, not operating at arm’s length.

Strategic zones and the role of Hainan

Special trade zones, particularly Hainan, remain central to China’s luxury strategy. Duty-free retail, cross-border consumption and pilot digital trade frameworks position the island as a living laboratory for the new law’s ambitions.

For luxury groups, Hainan continues to serve as a bridge between domestic demand and international brand positioning, with regulatory experimentation that may later be scaled nationwide.

What luxury leaders should prepare for now

Although implementation begins in 2026, strategic preparation must start immediately. The revised Foreign Trade Law reshapes the operating environment in four decisive ways:

Compliance becomes strategic – legal, digital and sustainability frameworks converge

Digital infrastructure is no longer optional – trade, data and logistics must be integrated

Supply chains require geopolitical resilience – agility will outweigh cost optimization

China’s market logic evolves – access remains vast, but expectations rise

For luxury executives, China is not closing its doors. It is redesigning the entrance.

The brands that thrive will be those that understand the law not as a constraint, but as a blueprint for how China envisions its role in global commerce: technologically advanced, environmentally disciplined and strategically autonomous.

As global trade fragments and consumption patterns shift, this reform positions China to shape the next chapter of international luxury exchange—on its own terms.

China once again demonstrates its ability to predict and redefine the rules of global luxury. In the run-up to Chinese New Year, the country has activated a strategic combination that is transforming premium travel retail: the full operational rollout of Hainan as a free trade island and the rapid expansion of downtown duty-free stores, led by China Duty Free Group (CDFG).

China is once again making a decisive move on the global high-end consumption chessboard. The Chinese government has approved the implementation rules of the new VAT Law, a regulatory framework that will fully enter into force on January 1, 2026 and goes far beyond a technical tax adjustment. It represents a structural redefinition of what is considered consumption within China, a pivotal concept that will directly affect luxury brands, travel retail operators, and international players that have historically relied on complex fiscal architectures to operate in the country.

China’s luxury market is entering a new phase of accelerated maturity that is reshaping the sector’s foundations. After years of growth driven by aspiration toward European maisons, Chinese consumers—particularly urban, culturally fluent and digitally native—are increasingly gravitating toward brands that resonate with their own identity, heritage and contemporary aesthetic codes. In this evolving landscape, domestic players such as Songmont in leather goods and Laopu Gold in fine jewellery are emerging not as secondary options, but as fully fledged premium competitors.

After two years of volatility, China is once again entering an expansion phase that is reshaping the global luxury landscape. In 2026, the country regains its position as one of the sector’s most powerful growth engines, driven by young consumers, a renewed appetite for premium experiences, and the rise of a new generation of local luxury brands.

The challenge lies in recovering the ground lost during the recent slowdown in Chinese luxury spending, a decline shaped by economic uncertainty, reduced outbound tourism and shifts in domestic taxation. However, various macroeconomic indicators point to a subtle but real rebound. LVMH has detected a renewed appetite for high-end physical experiences among Chinese consumers, who once again seek spaces that combine architecture, storytelling, craftsmanship and impeccable service. These are not simply retail sites; they are immersive environments designed to strengthen desire and reinforce prestige.

LVMH is preparing one of its most ambitious moves in the Asian market: the near-simultaneous opening of four multi-level flagship stores for Louis Vuitton, Dior, Tiffany & Co., and Loro Piana in the Chinese capital. Each space will occupy several floors in prestige locations — including Taikoo Li and Wangfujing — with the aim of redefining the physical luxury experience in the world’s largest market for high-end consumers.

A bag with the label “Made in Italy” displayed in an exclusive boutique may have been born thousands of miles away from Europe. Today we know that some of the most prestigious luxury brands in the world manufacture much of their products in China or other Asian countries, only to label them as European and sell them at exorbitant prices. This investigative report explores recent cases that have uncovered this practice, the techniques the industry uses to conceal it, the legal framework that allows it, the reactions it has provoked, and the ethical implications that challenge the true meaning of luxury.

LUXONOMY announces the launch of the highly anticipated report “Profile of the New Chinese Luxury Consumer 2025”, an essential tool for understanding the trends and behaviors of one of the most dynamic and strategic markets in global luxury. Exclusive to our PREMIUM subscribers, this report offers a detailed and practical insight for brands and professionals looking to stand out in the Chinese market.

On Wednesday, January 29, 2025, the Chinese New Year begins, a celebration of great cultural and economic significance that symbolizes new beginnings, opportunities, and growth. In the luxury sector, this date has become a key moment to connect with Chinese consumers, who lead the global consumption of personal luxury goods.

In line with this important celebration, LUXONOMY is preparing to present, next week, its exclusive Report on the Profile of the New Chinese Luxury Consumer, a comprehensive analysis that reveals the trends, preferences, and purchasing behaviors of this influential group of consumers.

With this report, we provide a strategic guide to understanding and seizing the opportunities presented by the Chinese market, which will continue to lead the luxury sector in the coming years.

In 2024, China’s luxury market faces a new challenge: “luxury shame.” This phenomenon is reshaping strategies for high-end brands due to economic downturns and government policies aimed at curbing conspicuous consumption. Chinese consumers, influenced by economic uncertainty and social pressures, now prefer discreet products that retain long-term value over flashy items perceived as excessively opulent.

This shift is not just an economic reflection but also a cultural transformation. Recent economic fluctuations in China have caused uncertainty among consumers who previously viewed luxury goods as essential status symbols. This economic instability is compounded by government measures promoting frugality and responsibility, steering consumer behavior toward more conscious and less overt displays of wealth.

Influencer marketing has emerged as an essential strategic tool for luxury brands seeking to consolidate and expand their presence in the Chinese market. This report provides a comprehensive analysis of the current state of influencer marketing in China’s luxury sector, emerging trends, challenges, and opportunities in this evolving market.